Greece ranks 31st in Travel & Tourism Competitiveness Report 2015

Greece ranked 31st in the world ranking of the Global Competitiveness Index in Tourism among 141 countries

Greece ranked 31st in the world ranking of the Global Competitiveness Index in Tourism among 141 countries

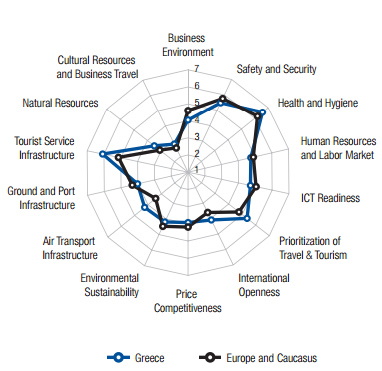

Greece ranked 31st in the world ranking of the Global Competitiveness Index in Tourism among 141 countries, by achieving an overall competitiveness score of 4.36 on the scale from 1 to 7.

The top-5 countries are Spain, France, Germany the US and the United Kingdom.

The Travel & Tourism Competitiveness Report 2015 features the latest iteration of the Travel & Tourism Competitiveness Index (TTCI). The TTCI measures “the set of factors and policies that enable the sustainable development of the Travel & Tourism (T&T) sector, which in turn, contributes to the development and competitiveness of a country.”

Published biennially, the TTCI benchmarks the T&T competitiveness of 141 economies.

The Report provides a platform and a strategic benchmarking tool for business and governments to develop the T&T sector. By allowing cross-country comparison and benchmarking countries’ progress on the drivers of T&T competitiveness, it informs policies and investment decisions related to T&T development.

RESULTS OVERVIEW

Spain tops the 2015 edition of the TTCI global rankings for the first time, followed by France (2nd), Germany (3rd), the United States (4th), the United Kingdom (5th), Switzerland (6th), Australia (7th), Italy (8th), Japan (9th) and Canada (10th). Regional Results Europe, with six economies in the top 10, continues to dominate the rankings thanks to its world-class tourism service infrastructure, excellent health and hygiene conditions, and—notably, thanks to the Schengen Area— high degree of international openness and integration.

However, there are still some significant divides across the region—not all European countries are making the most of their cultural resources, prioritizing the T&T sector to respond to new trends, or fostering a dynamic business environment by removing red tape.

In the Americas, the United States (4th) and Canada (10th) are followed by Brazil (28th), Mexico (30th) and Panama (34th). There are significantly different challenges in the region: in North America, travel facilitation, price competitiveness and continuous infrastructure upgrade are the main priorities in the T&T development agendas; in Central and South America, infrastructure gaps, safety and security and business environment issues are the main hurdles restraining further T&T development.

The top five performers in the Asia-Pacific are among the region’s more advanced economies: Australia (7th), Japan (9th), Singapore (11th), Hong Kong SAR (13th) and New Zealand (16th). However, the most significant growth in international arrivals is observed in South-East Asia, thanks in part to its region’s price competitiveness and the rapid expansion of its middle class. Developing regional cooperation on visa policies could further boost tourism, though investments are also needed in digital connectivity, infrastructure and protection of rich but depleting natural capital.

In the Middle East and North Africa, the United Arab Emirates (24th) leads the ranking, followed by Qatar (43rd), Bahrain (60th), Morocco (62nd) and Saudi Arabia (64th). Most of the economies in this region are price-competitive destinations and several have built significant T&T industries in recent years. However, concerns about security have limited international arrivals, even though secluded tourism resorts are far from the most dangerous areas. Improvement is also Executive Summary viii | The Travel & Tourism Competitiveness Report 2015 needed in international openness and environmental sustainability.

Sub-Saharan Africa showcases South Africa (48th), the Seychelles (54th), Mauritius (56th), Namibia (70th) and Kenya (78th) as its five most T&T competitive economies. Many countries in the region are working on their openness and visa policies, though the longstanding challenges of infrastructure and health and hygiene standards need to be tackled to unleash the potential of the T&T sector as a catalyst for development. Improving the business environment and preventing depletion of natural resources are also priorities for many countries.

KEY FINDINGS

Published under the theme “Growing through Shocks”, the full edition of the Report (available online) features three additional chapters authored by leading experts and practitioners: “Adapting to Uncertainty—The Global Hotel Industry”, by Deloitte (chapter 1.2); “How to Re-Emerge as a Tourism Destination after a Period of Political Instability”, by Strategy& (chapter 1.3), and “Global Air Passenger Markets: Riding Out Periods of Turbulence”, by the International Air Transport Association (IATA) (chapter 1.4). These chapters showcase how the T&T sector has been resilient to various types of shock from different angles (occupancy rates, international arrivals and investments and air passengers). Four key findings emerge from the results of the 2015 TTCI in combination with other quantitative and qualitative analysis from data partners.

• First, the T&T industry continues to grow more quickly than the global economy as a whole. As proof of its resilience, the analysis shows that the sector’s growth—whether in terms of global air passenger traffic, occupancy rates or international arrivals—tends to return to trend quickly after a shock.

• Second, countries performing more strongly on the TTCI are those that are better prepared to capture the opportunities of new trends: growing demand from emerging and developing countries; the differing preferences of travellers from aging populations and a new generation of younger travellers; and the growing importance of online services and marketing, especially through mobile internet.

• Third, developing the T&T sector provides growth opportunities and social benefits for all countries, regardless of their wealth. Several developing and emerging economies are ranked among the 50 most T&T competitive economies. A strong T&T sector translates into job opportunities at all skill levels.

• Fourth, the development of the T&T industry is complex, requiring inter-ministerial coordination and often international and public-private partnerships to overcome financial, institutional and organizational bottlenecks.

DATA PRESENTATION

The Report contains an extensive data section, which features individual scorecards for each of the 141 economies covered by the TTCI. These provide a complete snapshot of a country’s performance in all the components of the TTCI, including the 90 individual indicators as well as additional key indicators, to offer a complete picture of a country’s T&T’s sector. In addition, the data tables reporting global rankings and scores for each of the 90 indicators provide an overview of the global situation of the most relevant T&T measures available. Visit www.weforum.org/ttcr for additional material, interactive scorecards and rankings, and to download data.

The world's 20 safest countries, according to the WEF

- Finland - rating: 6.7

- Qatar - 6.61

- UAE - 6.6

- Iceland - 6.5

- Austria - 6.47

- Luxembourg - 6.46

- New Zealand - 6.41

- Singapore - 6.4

- Oman - 6.38

- Portugal - 6.33

- Switzerland - 6.32

- Hong Kong - 6.31

- Australia - 6.24

- Slovenia - 6.2

- Ireland - 6.18

- Belgium - 6.18

- Netherlands - 6.16

- Norway - 6.1

- Sweden - 6.1

- Germany - 6.06

COUNTRY PROFILE FOR GREECE

INDICATOR VALUE RANK/141

International Openness........................................ 4.1............25

7.01 Visa requirements (0–100 best)* ........................ 23.0............72

7.02 Openness of bilateral ASA (0–38)*..................... 11.2............63

7.03 No. of regional trade agreements in force*......... 46.0..............1

Price Competitiveness......................................... 3.9.......... 113

8.01 Ticket taxes, airport charges (0–100 best)*........ 80.6............64

8.02 Hotel price index (US$)*................................... 141.1............59

8.03 Purchasing power parity*..................................... 0.9..........115

8.04 Fuel price levels (US$ cents/litre)*.................... 206.0..........130

Environmental Sustainability............................... 4.2............ 61

9.01 Stringency of environmental regulations† ............. 4.0............68

9.02 Enforcement of environmental regulations† .......... 3.5............93

9.03 Sustainability of T&T development†...................... 4.3............74

9.04 Particulate matter (2.5) concentration (µg/m3)*.... 11.6............94

9.05 No. of envtl. treaty ratifications (0–27 best)*.......... 23............11

9.06 Baseline water stress (0–5 worst)*....................... 3.3..........100

9.07 Threatened species (% total species)* ................. 5.7............83

9.08 Forest cover change (% average per year)* ....... –2.8............69

9.09 Wastewater treatment (%) * ............................... 87.3............15

9.10 Coastal shelf fishing pressure (tonnes per km2)*.... 0.1............58

Air Transport Infrastructure ................................. 4.2............27

10.01 Quality of air transport infrastructure†................... 5.2............40

10.02 Airline dom. seat kms per week (millions)* ......... 48.4............37

10.03 Airline int’l. seat kms per week (millions)*......... 575.2............33

10.04 Departures per 1,000 pop.*................................. 9.0............37

10.05 Airport density per million urban pop.*................. 4.6............19

10.06 No. of operating airlines*.................................. 104.0............14

Ground and Port Infrastructure............................ 4.0............ 51

11.01 Quality of roads ................................................... 4.3............55

11.02 Quality of railroad infrastructure ........................... 2.9............56

11.03 Quality of port infrastructure† ............................... 4.7............49

11.04 Quality of ground transport network† ................... 4.7............51

11.05 Railroad density (km/surface area)*...................... 1.9............38

11.06 Road density (km/surface area)*............................ ®............39

11.07 Paved road density (km/surface area)*................... ®............33

Tourist Service Infrastructure.............................. 6.1............12

12.01 Hotel rooms per 100 pop.*.................................. 3.6..............2

12.02 Extension of business trips recommended† ......... 5.6............48

12.03 Presence of major car rental companies† ............... 7..............1

12.04 ATMs accepting Visa cards per million pop.*... 669.3............47

Natural Resources ............................................... 3.5............ 46

13.01 No. of World Heritage natural sites*........................ 1............43

13.02 Total known species*.......................................... 474............81

13.03 Total protected areas (% total territorial area)*.... 21.5............35

13.04 Natural tourism digital demand (0–100 best)* ....... 45............32

13.05 Quality of the natural environment† ...................... 5.2............38

Cultural Resources and Business Travel ............. 2.8............ 32

14.01 No. of World Heritage cultural sites* ..................... 16............10

14.02 No. of oral and intangible cultural expressions* ...... 2............41

14.03 No. of large sports stadiums* ............................ 12.0............34

14.04 No. of international association meetings* ....... 125.3............35

14.05 Cult./entert. tourism digital demand (0–100 best)*.. 22............31

Business Environment......................................... 4.0.......... 104

1.01 Property rights†.................................................... 3.9............82

1.02 Impact of rules on FDI†........................................ 3.0..........131

1.03 Efficiency of legal framework settling disputes†.... 2.7..........125

1.04 Efficiency of legal framework challenging regs.† ... 2.7..........113

1.05 No. of days to deal with construction permits* ... 124............56

1.06 Construction permits cost (%)* ............................ 0.6............30

1.07 Extent of market dominance† .............................. 3.9............59

1.08 No. of days to start a business*............................ 13............73

1.09 Cost to start a business (% GNI/capita)*.............. 2.2............38

1.10 Effect of taxation on incentives to work† .............. 2.5..........135

1.11 Effect of taxation on incentives to invest†............. 2.4..........138

1.12 Total tax rate (% profit)*...................................... 49.9..........114

1.12a Labour and contributions tax rate (% profit)*...... 31.0..........124

1.12b Profit tax rate (% profit)*..................................... 18.2............76

1.12c Other taxes rate (% profit)*................................... 0.7............27

Safety and Security ............................................. 5.5............ 57

2.01 Business costs of crime and violence†................. 4.9............45

2.02 Reliability of police services† ................................ 4.4............58

2.03 Business costs of terrorism† ................................ 5.3............69

2.04 Index of terrorism incidence* ............................... 6.1..........121

2.05 Homicide rate*........................................................ 2............42

Health and Hygiene ............................................. 6.6..............9

3.01 Physician density per 1,000 pop.* ....................... 4.4..............3

3.02 Access to improved sanitation (% pop.)* ........... 99.0............38

3.03 Access to improved drinking water (% pop.)* .. 100.0..............1

3.04 Hospital beds per 10,000 pop........................... 48.0............31

3.05 HIV prevalence (% pop.)*..................................... 0.2..............1

3.06 Malaria incidence per 100,000 pop.*..................S.L............n/a

Human Resources and Labour Market................ 4.7............ 45

Qualification of the labour force ........................... 5.5............46

4.01 Primary education enrolment rate (%)*............... 99.5..............9

4.02 Secondary education enrolment rate (%)*........ 107.9............13

4.03 Extent of staff training†......................................... 3.6..........111

4.04 Treatment of customers† ..................................... 4.6............62

Labour market ..................................................... 4.0............78

4.05 Hiring and firing practices†................................... 3.6............91

4.06 Ease of finding skilled employees† ....................... 4.5............36

4.07 Ease of hiring foreign labour† ............................... 4.3............42

4.08 Pay and productivity†........................................... 3.3..........119

4.09 Female labour force participation (% to men)*...... 0.8............86

ICT Readiness...................................................... 4.7............ 49

5.01 ICT use for B2B transactions† ............................. 4.3..........101

5.02 Internet use for B2C transactions†....................... 4.3............80

5.03 Individuals using internet (%)* ............................ 59.9............54

5.04 Broadband internet subs. per 100 pop.* ........... 26.2............21

5.05 Mobile telephone subs. per 100 pop.*............. 116.8............59

5.06 Mobile broadband subs. per 100 pop.*............. 36.1............62

5.07 Mobile network coverage (% pop.)*................... 99.9............39

5.08 Quality of electricity supply .................................. 5.3............55

Prioritization of Travel & Tourism......................... 5.4............24

6.01 Government prioritization of T&T industry†........... 6.1............21

6.02 T&T gov’t expenditure (% gov’t budget)* ............. 8.0............18

6.03 Effectiveness of marketing to attract tourists† ...... 4.6............62

6.04 Comprehensiveness of T&T data (0–120 best)*... 72.0............52

6.05 Timeliness of T&T data (0–21 best)*................... 18.0............48

6.06 Country Brand Strategy rating (1–10 best)* ....... 65.5............7

Read the full report here.

RELATED TOPICS: Greece, Greek tourism news, Tourism in Greece, Greek islands, Hotels in Greece, Travel to Greece, Greek destinations , Greek travel market, Greek tourism statistics, Greek tourism report

01/10 18:42

A.Fiorentinos | Greece more friendly to tourists with investments of €380 million in infrastructure

01/10 16:45

01/10 15:54

01/10 15:50

2nd Day High School of Elliniko “Elli Alexiou” | Bridge of Solidarity with Sikinos on October 28th

01/10 15:48

Event | “The Future and Present of Cruising in Agios Nikolaos”

01/10 14:07

British Airways | 850,000 seats to Greece in 2025, strengthening the winter season

01/10 14:05

Stefanos Kollias: “Faros” sheds... light on the first national super-computer

01/10 14:01

01/10 13:57

Europe’s independent hotels saw rise in bookings and revenue during summer

01/10 11:15

01/10 11:12

Food recognized as cultural resource at IGCAT World Gastronomy Congress

01/10 11:09

The Region of Central Macedonia at the IFTM Top Resa exhibition in Paris

01/10 10:30

Milestone for Agios Nikolaos: Largest Cruise Ship Ever Berths Following Infrastructure Upgrades

01/10 10:28

Evaluation of Olympus as a UNESCO World Cultural and Natural Heritage Site

01/10 10:25

How does a government shutdown affect tourism in the United States?

01/10 07:46

M. Vlatakis: Flight Delays Hurting Last-Minute Bookings - Bill Should Be Discussed After Season

01/10 07:41

Delays, screeches and air battles between the Ministry and controllers at airports

01/10 07:36

Alimos Marina: The road to a 100 million euro redevelopment for tourism and yachting is open

01/10 07:35

Theatre Season 2025–2026: Ten Productions That Will Make Headlines

01/10 07:10

01/10 07:07

N. Charalambous on TN | Seaplanes start in 2026 - Greece can become a global center

01/10 07:02

Caretta-Caretta and sustainable tourism: Conditions for the new Camping Thelia camp

01/10 07:00

01/10 06:56

01/10 06:52

New model for buying a Corfu home – Housing and investment in fast track | Roula Rouva in TN

01/10 06:12

30/09 21:14

Olga Kefalogiani at the WTTC summit | Emphasis on promoting cultural tourism

30/09 16:03

Athens hosts the “heart” of international cinema and television (October 4 - 7)

30/09 13:06

Crete’s dynamic presence at the TOP Resa 2025 International Tourism Exhibition in Paris

30/09 12:23

Emirates | Open Days to recruit new cabin crew members in Greece

30/09 12:18

Radisson Hotel Group doubles its presence in Greece with 5 new hotels

30/09 12:16

GNTO Serbia: Strong interest from Bosnia for tourism in Greece

30/09 11:59

ForwardKeys | September Vacations: Couples and Solo Travelers Dominate

30/09 11:52

Civil Aviation Authority: | Flights as normal in Greece on October 1

30/09 11:35

30/09 11:32

Honoring the memory of Spyros Kokotos at the 6th Cretan Street Cooking Festival

30/09 11:30

Chania: Record cruise ship and passenger arrivals in the first nine months of 2025

30/09 11:27

Pieria | P.O.T.A.P. Meeting with executives of the Polish tour operator “Grecos”

30/09 11:25

Greece is the fifth most expensive European destination in 2025

30/09 10:38

30/09 08:48

30/09 08:43

TikTok is dynamically entering tourism with new advertising and booking tools

30/09 07:58

Kimolos seems to be the first to “win” the bet on extending the season

30/09 07:53

30/09 07:53

Play Airlines: Sudden “stop” in all flights – the connection with Athens

30/09 07:50

Transavia & Condor | New connections to Karpathos, Mytilene, Skiathos, Kalamata and Zakynthos

30/09 07:46

30/09 07:18

“An Evening Under the Olive Tree”: The Naxos Autumn Festival Returns

30/09 07:16

Tianjin opens its doors to Greek entrepreneurship (and tourism)

30/09 07:14

5th Rodantheos Road in Heraklion: Running in memory of Rodantheos Spetsotaki

30/09 07:11

30/09 07:09

30/09 07:02

WTTC | Europe is the “engine” of global tourism with a contribution of 1.7 trillion to GDP

30/09 06:30

30/09 02:59

Publication: "Tourism of the Dodecanese in the period of the Great Crisis 2015 - 2023".

30/09 02:46

30/09 02:18

Corfu Port | ARGONAUT project for sustainable maritime tourism begins

30/09 01:52

Former New York Mayor Bill de Blasio at Athens Democracy Forum 2025

29/09 19:04

Society of Euboean Studies: Lecture by Historian - Author Lena Divani in Aliveri

29/09 18:16

K. Pierrakakis: Rents for special categories of public servants with contracts up to 6 months

29/09 18:14

N. Kerameos meets with company representatives ahead of "Rebrain Greece" in New York

29/09 18:06

Recruitment of 80 air traffic controllers from the A.S.E.P competition

29/09 17:19

Kalamaria “revives” Thessaloniki’s past through art and Artificial Intelligence

29/09 16:24

The 4th Chios Festival - From Antiquity to Artificial Intelligence is Completed

29/09 15:59

Withdrawal of investment upgrade of "Nafsika" in Asteras Vouliagmenis and return of subsidy

29/09 15:30

29/09 15:27

BEST WESTERN | Partnership of Greek-Italian offices with "dynamic" of 200 hotels in 15 countries

29/09 14:36

29/09 14:33

29/09 13:44

€600,000 promotional actions for Thessaloniki are financed by GNTO

29/09 13:39

29/09 13:00

WTTC Global Summit in Rome: Europe at the heart of global tourism

29/09 12:55

WTTC Summit in Rome: Governments and tourism giants chart the global roadmap

29/09 12:53

Pieria “traveled” to Paris with a dynamic presence at Top Resa 2025 exhibition

29/09 12:47

29/09 12:21

Italy Wedding Destination | 15,000 Weddings a Year, €1 Billion in Revenue

29/09 12:11

29/09 12:05

29/09 11:37

Grecotel "introduces" Greece to the Indian luxury tourism market

29/09 11:28

29/09 10:39

Olga Kefalogianni | The strategic importance of Medical Tourism

29/09 06:56

29/09 06:53

27/09 06:56

26/09 20:08

Air Traffic Controllers: Systems are outdated – The system is incompatible with European regulations

26/09 18:13

E.X. Messinias | Ready to assist any initiative that will highlight our place

26/09 15:46

The 11th “FVW workshop Greece” will be held in Kos, with visits to Nisyros and Kalymnos

26/09 14:56

26/09 14:55

Open letter to island visitors: What would you like to see when visiting a Greek island?

26/09 14:52

Spyros Halikiopoulos: “The goal is the transition to sustainable tourism - People at the center

26/09 14:07

PASYXE for World Tourism Day 2025 | Commitment to sustainable development

26/09 14:04

The Ambassador of Pakistan to the Heraklion Chamber - interest in Cretan products

26/09 13:22

26/09 13:19

Meetings of the Secretary General of GNTO at IFTM – Top Resa 2025

26/09 13:17

M. Konsolas: The big bet is regional development and the regeneration of mountainous areas

26/09 13:11

Samos | International Conference on Disaster Management with Leading International Scientists

26/09 11:27

Istanbul | Taxi Drivers’ Licenses Revoked for Overcharging Tourists

26/09 10:29

Thessaloniki welcomes the annual conference of the Polish Chamber of Tourism

26/09 07:37

New Entry/Exit System (EES) coming to Europe for third-country travellers

26/09 07:12

World Tourism Day 2025 | Angeliki Mitropoulou: Carrying capacity is the safety valve

Play Airlines: Sudden “stop” in all flights – the connection with Athens

Radisson Hotel Group doubles its presence in Greece with 5 new hotels

Emirates | Open Days to recruit new cabin crew members in Greece

Honoring the memory of Spyros Kokotos at the 6th Cretan Street Cooking Festival

GNTO Serbia: Strong interest from Bosnia for tourism in Greece

Chania: Record cruise ship and passenger arrivals in the first nine months of 2025

TikTok is dynamically entering tourism with new advertising and booking tools

Pieria | P.O.T.A.P. Meeting with executives of the Polish tour operator “Grecos”

Kimolos seems to be the first to “win” the bet on extending the season

Transavia & Condor | New connections to Karpathos, Mytilene, Skiathos, Kalamata and Zakynthos

Civil Aviation Authority: | Flights as normal in Greece on October 1

Athens hosts the “heart” of international cinema and television (October 4 - 7)

Crete’s dynamic presence at the TOP Resa 2025 International Tourism Exhibition in Paris

ForwardKeys | September Vacations: Couples and Solo Travelers Dominate

Tianjin opens its doors to Greek entrepreneurship (and tourism)

“An Evening Under the Olive Tree”: The Naxos Autumn Festival Returns

5th Rodantheos Road in Heraklion: Running in memory of Rodantheos Spetsotaki

Greece is the fifth most expensive European destination in 2025

facebook

facebook twitter

twitter google+

google+ print

print Email

Email